This week, I am delighted to share a guest blog post to help your financial management from Carolyn Mescher, an Entertainment CPA and musician from Nashville, TN who specializes in music accounting and taxes. As an artist and songwriter herself, Carolyn is intimately familiar with both the business and creative side of the music industry. Carolyn wrote this article after seeing how too many musicians overpaid their taxes by missing valuable deductions. She is currently writing a tax book, specifically for musicians which will be available in the first quarter of 2016. Check out her website at www.MescherCPAs.com.

What every musician, artist, songwriter, and music professional should know before filing 2015 taxes.

While preparing taxes, I have come across far too many musicians, artists, songwriters, sound techs and managers who overpay the IRS because they missed thousands of dollars of deductions.

While preparing taxes, I have come across far too many musicians, artists, songwriters, sound techs and managers who overpay the IRS because they missed thousands of dollars of deductions.

Please let me save you a few hundred or thousand dollars! Before you overpay the IRS again, prepare your returns with the six deductions that are most often missed by musicians.

1. 1. Meal Allowances: Take out your touring schedule and calendar. If you do not already have a calendar that shows each city you toured and your “on the road” days while touring, create one based on your records. There are specific meal allowances for each city you stay in. Moreover, if you were paid a per diem, compile those amounts as well, since these payments reduce the amount of meal allowances you are allowed to deduct.

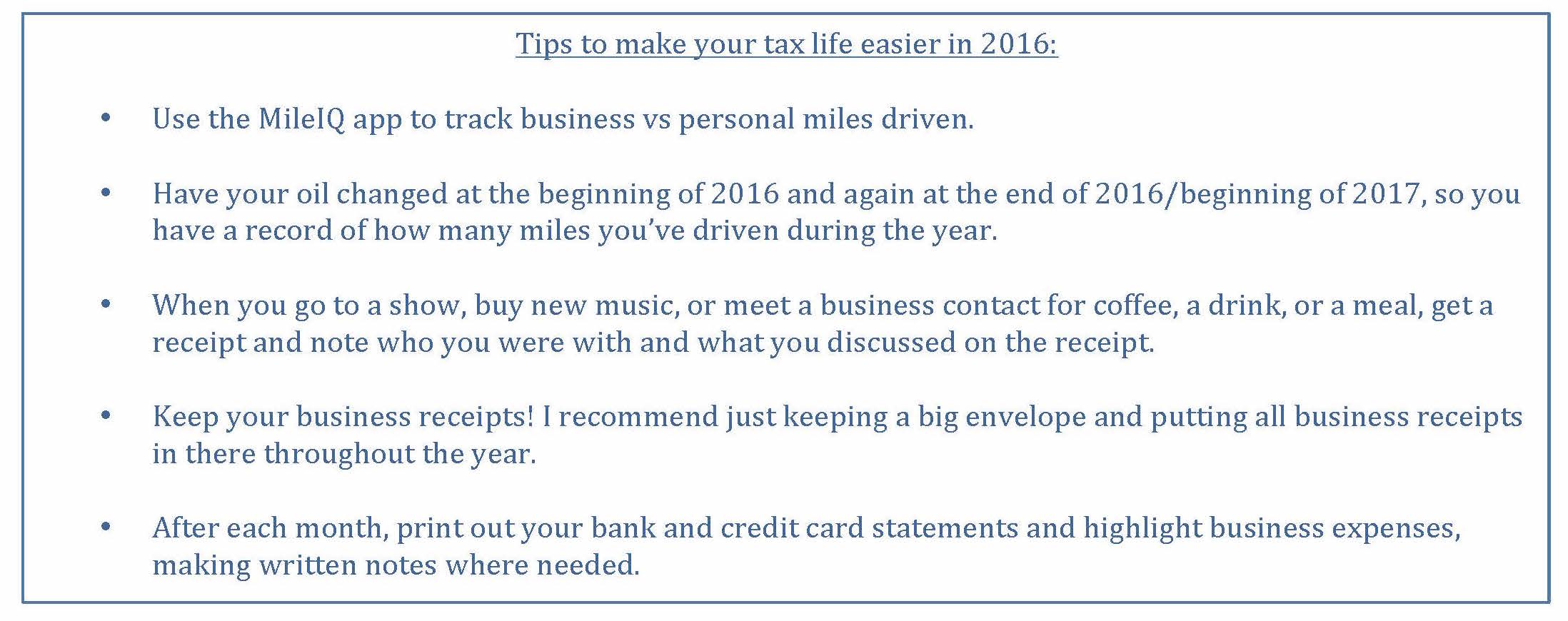

2. Internet and Cell phone bills: As a self-employed freelancer, you use your cell phones and internet for professional reasons including getting gigs and shows, marketing and promotion. These are considered necessary business expenses. Track your expenses on a spreadsheet so that you can total them up for your tax returns.

3. Determine how many business miles you drove in 2015: Record how many miles you drove for touring and other professional reasons. If you did not keep a record, refer to your touring calendar and find the driving distances to and from cities. The 2015 mileage deduction is $0.575/mile.

4. Membership fees and Subscriptions: The fees that you pay to professional musician associations and and all subscriptions to professional magazines and other professional publications are also deductible.

5. Equipment and Fees to Other Professionals: Did you purchase any new equipment, strings or pay for other instrument maintenance this this? How about payments to photographers,other musicians or producers? . Compile receipts, check images, or charges, as these add up quickly and are huge deductions!

6. Do you use a room in your house as a studio? You can deduct utilities and rent proportionate to the square footage used in your studio divided by your total home square footage.

The information contained within this article is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional tax preparer or certified public accountant. Presentation of the information is not intended to create, and receipt does not constitute, a tax planner-client or financial-planner-client relationship. Internet subscribers, users and online readers are advised not to act upon this information without seeking the service of a professional tax preparer or certified public accountant.